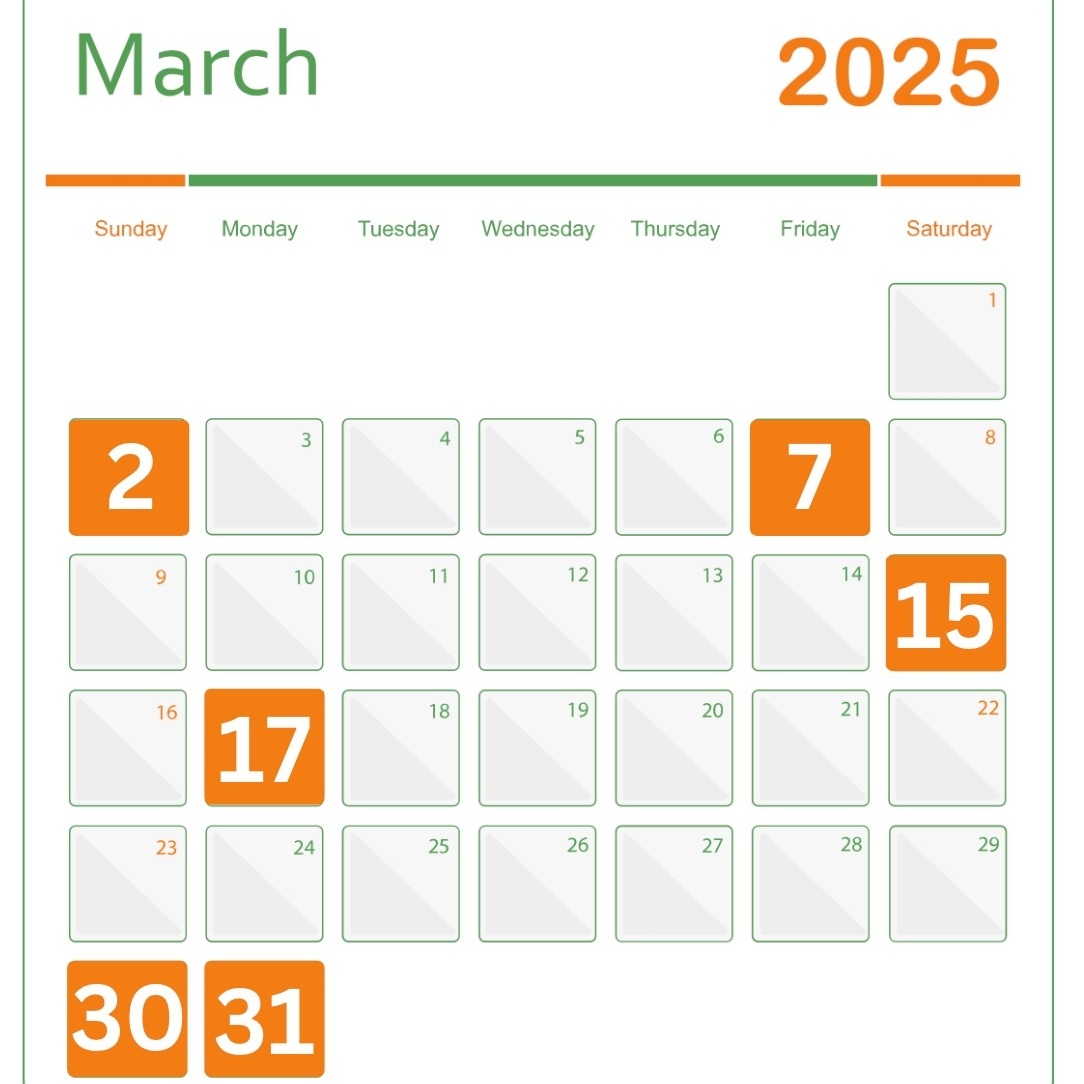

Income Tax and GST compliance deadlines for March 2025 in India:

As we approach March 2025, it’s crucial for businesses and individuals in India to stay informed about key tax compliance deadlines to ensure timely adherence and avoid penalties. Below is a comprehensive guide outlining the important due dates for Income Tax and Goods and Services Tax (GST) for the month of March 2025.

Income Tax Compliance:

March 7, 2025: Due date for deposit of TDS/TCS for February 2025. Government offices paying without a challan must deposit on the same day as deduction.

March 15, 2025:

- Fourth installment of advance tax for Assessment Year (AY) 2025-26.

- Full payment of advance tax for taxpayers under the presumptive taxation scheme (sections 44AD/44ADA) for AY 2025-26.

- Submission of Form 24G by government offices for TDS/TCS deductions in February 2025 without a challan.

March 17, 2025: Issuance of TDS certificates for tax deducted in January 2025 under sections 194-IA, 194-IB, and 194S.

March 30, 2025: Due date for furnishing challan-cum-statement for tax deducted in February 2025 under sections 194-IA, 194-IB, 194M, and 194S.

- Section 194-IA: TDS on the purchase of immovable property.

- Section 194-IB: TDS on rent by certain individuals and HUFs.

- Section 194M: TDS on payments to contractors and professionals by individuals/HUFs not liable to deduct TDS under other provisions.

- Section 194S: TDS on payment for the transfer of virtual digital assets by specified persons.

March 31, 2025:

- Filing of Country-By-Country Report (Form No. 3CEAD) for the previous year 2023-24 by the parent or alternate reporting entity resident in India.

- Submission of Form 67 to claim foreign tax credit for income earned in the previous year 2022-23, provided the original return was filed within the specified time.

- Filing of an updated return of income for AY 2022-23.

GST Compliance:

March 11, 2025: Filing of GSTR-1 for February 2025 by taxpayers with an annual turnover exceeding ₹1.5 crore or those who have opted for monthly filing.

March 13, 2025: Submission of Invoice Furnishing Facility (IFF) for February 2025 under the QRMP scheme.

March 20, 2025: Filing of GSTR-3B for February 2025 by taxpayers with an annual turnover of more than ₹5 crore.

March 25, 2025: Payment of tax for February 2025 under PMT-06 by taxpayers under the QRMP scheme.

March 31, 2025:

- Filing of Letter of Undertaking (LUT) for FY 2025-26 to export goods/services without payment of IGST.

- Opting in for the Composition Scheme for FY 2025-26 by filing CMP-02.

- File Annuexure V or VI in case of GTA opting in or out from Reverse charge/Forward charge

- Take decision to opt in or out from QRMP scheme.